Life is like a marathon, and health is the key to success. Everyone wants to stay healthy; however, it is sometimes difficult, if not impossible, to avoid illness. It would be ideal if you can access appropriate treatment as soon as possible when you are sick. However, according to the Health Bureau, from 1989/90 to 2019/20, medical expenditure increased by an average of 5% year-on-year. Choosing between private and public medical services can also be tricky. There are various health plans in the market. Which kind of protection is the most suitable for you? Let’s learn about the types and benefits of health insurance, compare different health plans and see what you should do before and after enrolling insurance.

What is Medical Insurance?

The Hong Kong public healthcare system is overstretched, while private hospitals are expensive. Given this, the public’s demand for medical insurance has dramatically increased. Medical insurance mainly provides coverage for out-of-pocket reasonable medical expenses caused by injuries and illnesses, offers financial support for the insured and their family members, and pays for medical costs and follow-up treatments.

Types of Medical Insurance

There are different medical insurance products in the market. Before enrolling medical insurance, you should understand the types and coverage of each product. Medical insurance (or anything related to medical insurance) is mainly divided into the following five categories:

1. Hospital and Surgical Insurance

The insured claims part or all of their reasonable medical expenses incurred during hospitalization and/or rehabilitation, such as hospitalization fees, doctor’s fees, medication costs and surgical expenses, etc., on a reimbursement basis. The VHIS (Voluntary Health Insurance Scheme) launched in 2019 provides both hospitalization and surgical benefits.

2. Hospital Cash Insurance

Hospital cash insurance provides extra monetary protection according to the number of days you have to stay in a private or public hospital. For example, a plan will provide up to HK$2,000 per day of hospital cash benefit to cover the insured’s expenses for five days of hospitalization.

3. Cancer Insurance

It covers medical expenses incurred by the insured while receiving cancer treatment, including diagnosis, treatment and rehabilitation.

4. Critical Illness Insurance

Most critical illness protection covers over 100 serious illnesses, including cancer, stroke, heart disease, etc. A lump sum cash benefit will be paid if the insured suffers from the listed illnesses.

5. Company Medical Insurance/Group Medical Insurance

Group medical insurance provided by the company or the employer offers coverage for eligible employees without underwriting or additional health declaration until the termination of employment. In general, it covers outpatient, hospitalization and surgery expenses, etc.

Comparison of Medical and Health Insurance

| VHIS Plans | Hospital and Surgical Insurance (plans not under VHIS) | Cancer Insurance | Critical Illness Insurance | Company Medical Insurance | |

| Basic coverage | Reimbursement for all or part of the insured’s medical expenses incurred during hospitalization | Reimbursement for all or part of the insured’s medical expenses incurred during hospitalization | Covers medical expenses incurred by the insured during cancer treatment and/or rehabilitation | Mainly covers specified serious illnesses such as cancer, stroke, heart disease, etc. | Group medical benefits provided by companies or employers for employees. In general, it covers outpatient, hospitalization and surgery expenses, etc. |

| Unknown “pre-existing disease(s)” | ✓ | Subject to the relevant terms of the insurance company | |||

| Procedure for health declaration | Complete the simple health declaration procedure | Subject to the underwriting procedures of the insurance company | |||

| Guaranteed lifetime renewal | ✓ | Subject to the relevant terms of the insurance company | |||

Who Needs Health Insurance?

Medical insurance is always needed regardless of age or occupation, as injuries and illness are always sudden and unpredictable.

Workers: Group medical insurance generally has an upper limit. In addition, employees will lose relevant protection after resignation or retirement. Therefore, individual medical insurance can not only provide comprehensive medical protection but also complement the insufficiencies of group medical insurance.

In addition, medical insurance with a network covering all parts of the world is also indispensable for people who often need to travel overseas.

Self-employed/Slashers: The freelance work model is becoming more common in Hong Kong, and it is expected that more people will abandon continuous contracts with companies and enjoy the flexibility of self-employment. However, self-employed people/slashers are generally not entitled to employee benefits. Therefore, it is recommended that appropriate medical insurance be chosen according to individual needs to make up for the lack of coverage provided by corporate group medical insurance. Even in the face of a sudden illness, you can receive treatment and handle related expenses as soon as possible to avoid delaying the treatment and affecting your health.

Parents: Parents care most about their children’s health. Infants and young children, who have weak immune systems, are vulnerable to complications or serious diseases. All parents want to seek professional treatment for their children as soon as they are sick. However, public hospital services often mean a long waiting time, while clinics or private hospitals are far more expensive. When choosing medical insurance for your children, you can consider those plans that include hospitalization and surgical benefits, such as VHIS plans, to protect your children from their 15th day of birth.

In addition, more and more parents are sending their children to study abroad. Medical insurance offering worldwide coverage & access will bring a lot of convenience and peace of mind to parents.

Things to Consider Before Applying for Insurance

1. Consider Personal and Family Needs, and Financial Ability

Before enrolling insurance, the most important thing is to understand your needs for medical insurance because everyone or every family has different needs. The premium of an insurance plan will be adjusted according to various aspects, such as the insured’s health condition, age, and risk profile. Also, it is necessary to decide how much to spend on health insurance based on your preference for general, semi-private, or private wards and choose a suitable medical plan based on your affordability.

2. Pay Attention to the Cooling-off Period and Waiting Period

The “Cooling-off Period” allows policyholders to calmly re-examine whether they do need the protection within a reasonable time after their policies take effect. Many insurance companies provide health insurance or VHIS plans with cooling-off period. The cooling-off period of VHIS plans are established following the Guideline on Cooling-off Period (GL29) of the Insurance Authority and requirements of the Health Bureau and are generally 21 days, but some products in the market do offer a 30-day cooling-off period. If the insured change their mind after the policies take effect, they can cancel the policies during the cooling-off period and get a full refund of the premiums paid provided that there has been no claim submitted.

“Waiting Period” refers to a period after the policy takes effect during which, if the insured is diagnosed with the covered diseases listed in the policy, the insurance company has the right not to make compensation. Most medical plans in the market have a “waiting period”, which can range from 6 to 12 months for some individual diseases. Before purchasing insurance plans, you should check the terms and conditions set out in the insurance contracts.

3. Be Aware of Insurance Exclusions

Most insurance products will indicate exclusions. If the insured’s claim is related to the exclusions, the insurance company will not make compensation.

4. Make Health Declaration When Applying for Insurance

You must truthfully declare your health when applying for insurance. The insurance contract is premised on the principle of “utmost good faith”. The insurance company may refuse to pay compensation or cancel the policy in case of an untruthful declaration. Applications for most medical plans must go through the underwriting process. If you have certain diseases before applying for insurance, you must provide relevant documents or make a declaration. There may be exclusions, loading, or rejection of application after the underwriting process. In addition, diseases existing before your application will be defined as “pre-existing diseases”. Except for “the unknown pre-existing diseases” under by the VHIS, they are generally not covered. You should check the terms and conditions listed in the contract before buying insurance.

5. How to File a Claim

Each insurance company has its own procedures and channels for making claims. For example, the company may require the insured to submit claims through an online platform or in writing. Thanks to the popularity of mobile applications, most insurance companies have online platforms or mobile applications which allow the insured uploads claim documents and check the progress at any time, making the whole process convenient and fast.

FAQs about Medical and Health Insurance

1. What are the benefits of health insurance? Is it better to enroll insurance at a younger age?

The likelihood of severe diseases in younger generations is higher than we have seen in the past, and some people are even diagnosed with critical illnesses in their 30s and 40s. The younger you are to purchase medical insurance, the more protection you get, and the premium will be lower compared to purchasing at an older age. It’s natural for one to have a higher chance of getting sick when getting older. Suppose you purchase medical insurance at an older age when your body shows a warning sign. The insurance company may impose loadings or extra “exclusions” before accepting the insurance application. Insurance coverage is often significantly reduced and may not cover all medical expenditures.

2. Do I need to purchase personal medical insurance if I have company medical insurance?

Generally, workers perceive that personal medical insurance is unnecessary if the company provides group medical insurance. Of course, company medical insurance also covers outpatient, hospitalization, surgery and other expenses, but private hospitals are expensive, and company medical insurance may not fully cover all expenses. Moreover, the employee will lose their protection once they leave the company or retire. Here, if your medical insurance plan includes a deductible, you can claim part of the cost from the company’s medical insurance and the balance from your own medical insurance (for example, a VHIS plan) to reduce hospitalization expenses further.

3. How can I make good use of the deductible?

“Excess” or “deductible” refers to the amount of fees the policyholder must pay when claiming compensation from the insurance company. The insurance company will compensate you for the remaining medical expenses after deducting the “deductible” according to the coverage and upper limit of the health plan.

VHIS Explained: How to Buy VHIS with Deductible Options & Group Insurance

4. Admission and discharge processes, treatment procedures and medical terminology are too complicated. Can medical insurance help with these?

Everyone will be caught off guard in the face of sudden injuries. For those who are overwhelmed by the complicated admission and discharge processes or unfamiliar medical terminology and the treatment procedures, insurance companies will help their customers with admissions or claims issues through insurance agents or customer service hotlines. Some insurance companies even have a team with medical experience to provide customers with personalized follow-up services, reducing the hassle of understanding related treatments and procedures.

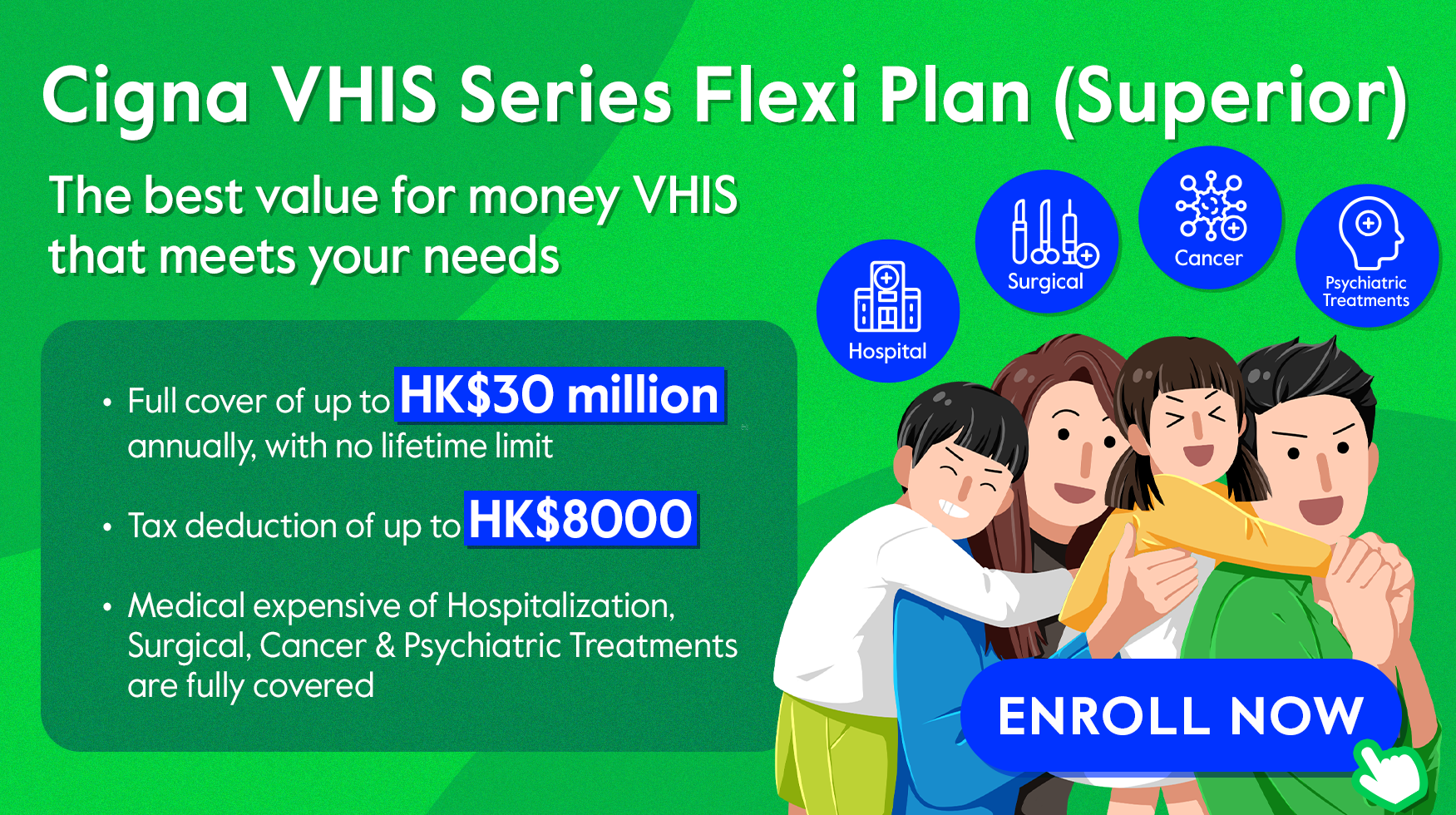

Plan ahead and choose a suitable medical plan according to your protection needs and financial ability. Don’t let medical expenses disrupt your financial plans! Cigna VHIS Flexi Plan(Superior) provides psychiatric treatment coverage during hospitalization and a lifetime benefit limit up to HK$ 30,000,000. Please click here for more details.

Cigna has a team of Care Managers, who are registered nurses with rich clinical experience to provide one-to-one medical support services for customers, including coordinating and following up on the arrangements for admission to hospital for surgery or treatment. To help customers focus on treatment and speed up recovery, they will also help select suitable network doctors, analyze various treatment plans, and develop personalized rehabilitation plans for customers after treatment, as well as emotional support, etc.