Long queues and overloading is common at public hospitals in Hong Kong. If budgets allow, many people would rather opt for the private sector for earlier treatments. However, private hospitals have various charging schemes and ward types. Is your insurance plan able to cover all your expenses at private hospitals? In this article, Cigna Smart Health will explain the coverage and premium related to semi-private or private ward plans.

Room Types of Private Hospitals

Common room types of private hospitals include general wards (standard rooms), semi-private rooms, and private rooms. Some hospitals may even provide more premium options, such as suite and VIP rooms. Below are the three standard room types with their services.

|

Room Types |

Services |

| General ward |

|

| Semi-private single room |

|

| Private room |

|

Comparison on Insurance Coverage by Room Types

In the market, you can choose your medical insurance plans of different room types with their respective premiums, depending on your needs and budget. Apart from hospitalization fees, some plans also cover medical expenses incurred from related items, such as private nurses, medical appliances, and post-hospitalization auxiliary treatment. Therefore, their annual coverage limits are relatively higher. You can see the comparison in the table below.

|

Common Medical Insurance |

High-End Medical Insurance |

|

|

Annual Premium* |

HK$3,000 up |

HK$10,000 up |

|

Annual Limit^ |

Around HK$ 300,000 to 3,000,000 |

Over HK$ 30,000,000 |

|

Room Types |

General Wards |

Semi-Private / Private / Premium Rooms |

|

Coverage |

Medical expenses may not be fully covered |

Fully covered^ |

*Estimate from a case of 35-year-old non-smoker

^Benefits are reimbursed on Medically Necessary and Reasonable and Customary basis

However, your actual premium rate is subject to your lifestyle, conditions, needs and insured amount. You are advised to consult your insurer before subscribing to a medical plan.

Can Cigna Policyholders Confine in Semi-Private or Private Rooms?

Cigna HealthFirst Elite 360 Medical Plan has been recognized as a preferred choice of high-end medical insurance plan in the market. It offers coverage on semi-private rooms and standard private rooms with superior annual limits of up to HK$30M and HK$50M, respectively. The Plan also garnered 5 Star Rating at Semi-Private Room Level.

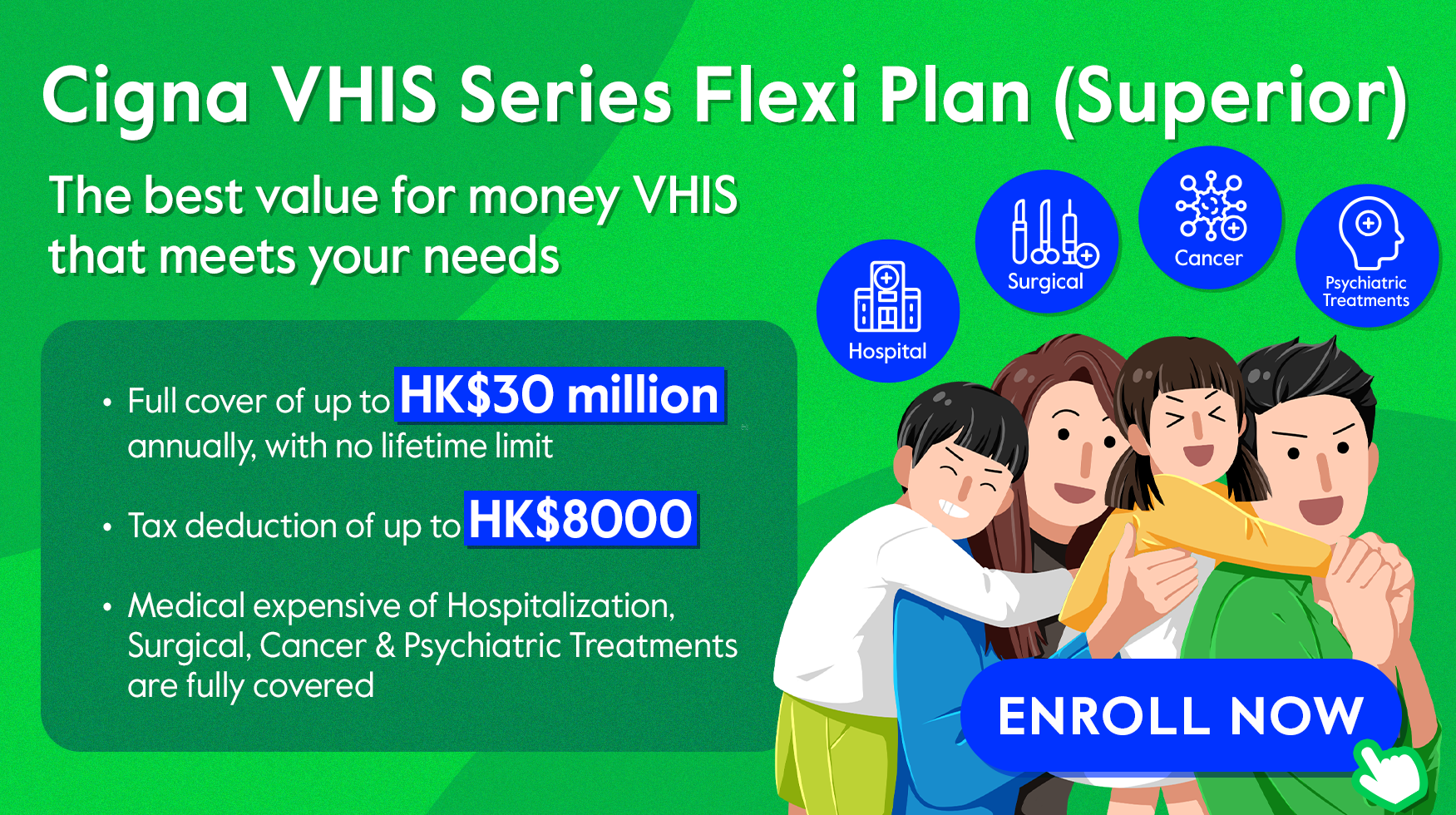

Furthermore, Cigna VHIS Series offers medical insurance plans according to your preferred accommodation room types, namely the Flexi Plan (Superior): Semi-Private and the brand-new Flexi Plan (Superior): Ward.

Cigna VHIS Series & Cigna HealthFirst Elite 360 Medical Plan

Traditional medical insurance plans set benefit limits for surgical expenses and other miscellaneous items. However, Cigna gets you covered on your medical expenses with high annual benefit limits of up to HK$30M and HK$50M offered by Cigna VHIS Series – Flexi Plan (Superior) and Cigna HealthFirst Elite 360 Medical Plan, respectively. With unlimited lifetime claims, you need not worry about future medical expenses. The table below shows the coverage details of our plans regarding hospitalization.

| Cigna VHIS Series – Flexi Plan (Superior): Semi-Private |

|

| Cigna VHIS Series – Flexi Plan (Superior): Ward |

|

| Cigna VHIS Series – Flexi Plan (SMM) |

|

| Cigna VHIS Series – Standard Plan |

|

| Cigna HealthFirst Elite 360 Medical Plan |

|

The above benefit items are for reference only. Benefits are reimbursed on a Medically Necessary and Reasonable and Customary basis.

Cigna VHIS Series offers you different medical insurance plans according to your needs. here for details.