Does medical insurance cover critical illnesses? It depends on whether your illnesses have existed prior to the cover under the policy starts. Before the Voluntary Health Insurance Scheme (VHIS) was launched in 2019, most medical plans did not cover unknown pre-existing conditions and congenital diseases. VHIS stands apart from other insurance plans with its coverage for these two items, but you should understand clearly its terms and conditions.

To illustrate this edge of VHIS, let’s have a look at the case of a policyholder, Iris. Two years after her purchase of traditional medical insurance, she was diagnosed with Stage IV breast cancer.

Before the diagnosis, she did not seek any medical advice, and her doctor stated that it had been a pre-existing condition when the policy started. Without adding any exclusions to her plan, the insurance company accepted her application. When she tried initiating a claim, the company denied it due to the unknown pre-existing condition. As such, many people think that buying medical insurance earlier the better.

However, this situation can be avoided if she bought a VHIS plan.

What Are Unknown Pre-Existing Conditions?

Unknown pre-existing conditions refer to any medical conditions and diseases that you were not aware of but existed prior to the cover under the policy starts.

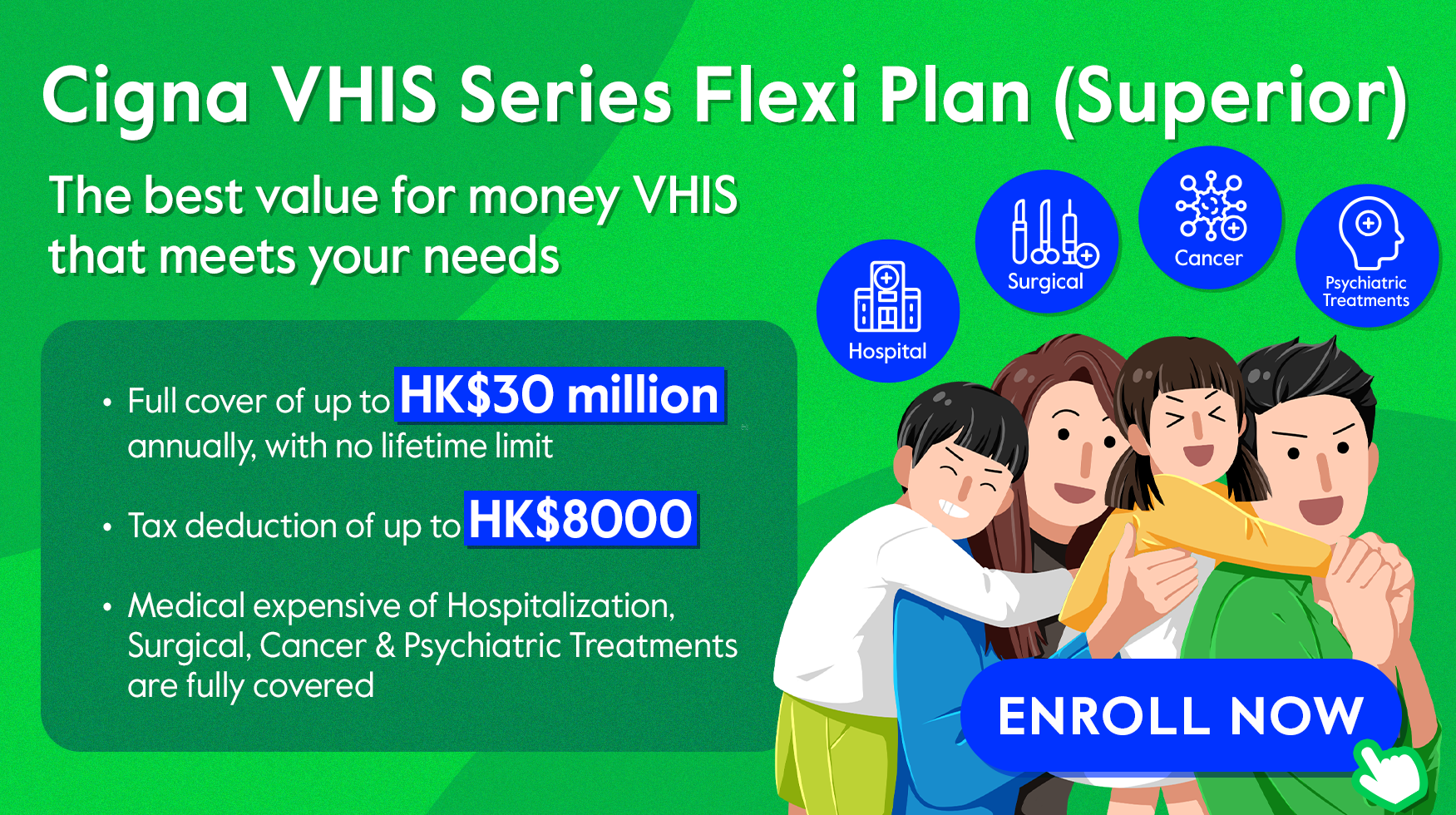

Under VHIS, unknown pre-existing conditions are well covered. Regarding the case of Iris, she was eligible to obtain a complete reimbursement starting from the first day of the policy if she bought the Cigna VHIS Series Flexi Plan (Superior).

What Are Pre-Existing Conditions?

You are considered to be aware of a Pre-existing condition where:

- it has been diagnosed.

- it has manifested clear and distinct signs or symptoms.

- medical advice or treatment has been sought, recommended or received.

Pre-existing conditions are not covered by both VHIS and other traditional medical insurance.

Congenital Condition Diagnosed after 8 Years Old Are Covered by VHIS

The entry age of the Cigna VHIS Series is from 15 days to 80 years old. Congenital conditions diagnosed after attaining the age of 8 are covered under VHIS.

VHIS’ coverage is more comprehensive than traditional medical insurance as the former covers congenital conditions, such as down syndrome, leukaemia, heart disease, etc. However, it is only applicable to congenital conditions that show clear signs or are diagnosed after reaching 8 years of age.

Reimbursement Arrangements of VHIS

You could have a better understanding of VHIS’ coverage with the following three examples.

|

Cases |

Conditions |

Eligibility for Reimbursement under the Cigna VHIS Series Flexi Plan (Superior) |

Reasons |

|

Case 1 |

The policyholder was diagnosed with diabetes and revealed related medical history to the insurance company. The company added diabetes and other implied diseases (such asheart disease) as exclusions. The policyholder had heart disease in the fourth policy year. |

No coverage |

The disease was listed as an exclusion, so the expenses incurred are not eligible for reimbursement. |

|

Case 2 |

The policyholder did not perform a bod check before purchasing the plan. However, he was diagnosed with Stage III colorectal cancer a month after the policy started. |

Full coverage |

It is considered an unknown pre-existing condition, so he can have the full reimbursement of the expenses incurred starting from the effective date. |

|

Case 3 |

No signs and symptoms were shown prior to the cover of the policy starts, but the policyholder was diagnosed with Stage II lung cancer in the fourth policy year. |

Full coverage |

It is considered an unknown pre-existing condition, so he can have the full reimbursement of the expenses incurred starting from the effective date. |

What is the Utmost Good Faith?

In the course of completing an insurance application, an individual will be required to provide specific information about the state of their health and their lifestyle habits in the utmost good faith. It is a legal requirement that all of these questions and disclosures are provided truthfully for an insurance company to evaluate the risks, calculate policy premium, list particular exclusions etc.

Should the policy applicant breach the principle of utmost good faith then the insurance company has the right not to compensate and the policy is typically rendered void. Please be aware of this while applying for insurance.

The new Cigna VHIS Series Flexi Plan (Superior) offers full coverage for unknown pre-existing conditions starting from the policy’s effective date. With an annual benefit limit of HK$30 million, you could enjoy comprehensive health protection with a full reimbursement of medical expenses.

Cigna makes health care simple, affordable, and predictable. Click here to learn more.

Sources: