There is a common confusion between critical illness insurance and general medical insurance. Instead of relying solely on what your insurance broker says, it is crucial to understand their difference before footing the bill.

Generally speaking, critical illness insurance provides coverage for cancer, stroke and heart attack—the three major critical illnesses. Critical illness insurance usually pays a lump sum benefit should the insured be diagnosed with a defined critical illness. Meanwhile, medical insurance products generally reimburse actual medical expenses.

|

Critical Illness Insurance |

General Medical Insurance |

|

|

Benefits |

One-off or multiple conditional payments |

Reimbursement |

|

Coverage |

Cancer, stroke, heart attack, and other defined critical illnesses |

Full or partial reimbursement of any hospitalization expenses |

Common Critical Illness Insurance Myths Debunked

Myth 1: Is it true that all medical expenses of critical illness are already covered by a Critical Illness plan?

Truth: A fixed sum will be provided upon diagnosis of a defined critical illness. The benefits are not limited to medical purposes; it is up to the insured to determine how to spend the money.

Myth 2: Does critical illness insurance cover all kinds of critical illnesses?

Truth: Every insurer has its own definition of “critical illness”. For example, some insurance does not cover carcinoma in situ, cancer recurrence, or specific types of cancers.

Myth 3: If I never made a claim for my Critical Illness plan, can I get back a premium return?

Truth: It would depend on the terms and conditions of the insurer. Some Critical Illness plans will provide a return of 100% total premium paid.

How to choose an insurance plan that best suits you?

Deciding which insurance to take depends on your needs and factors like age, health conditions and income. Let’s take a look at the following scenario.

Scenario: Breast cancer requiring annual medical expenses of HKD $1,000,000

|

Critical Illness Insurance |

Medical Insurance |

|

Lifetime Insurance Amount: HKD $1,000,000 |

Annual Insurance Amount: HKD $1,000,000 |

|

Annual Premium: HKD $33,070 |

Annual Premium: HKD $3,125 |

Extended Reading: How To Perform Breast Self-Exam

Which insurance would you choose?

You should always be alert for the unpredictable. In fact, general medical insurance and critical illness insurance can complement each other, to give you the comprehensive protection that saves you the financial hassle. While critical illness insurance covers unexpected serious illnesses such as cancer and heart attack and provides you with a lump-sum cash benefit, the general medical plan can support hospitalization expenses of minor surgery and accidents.

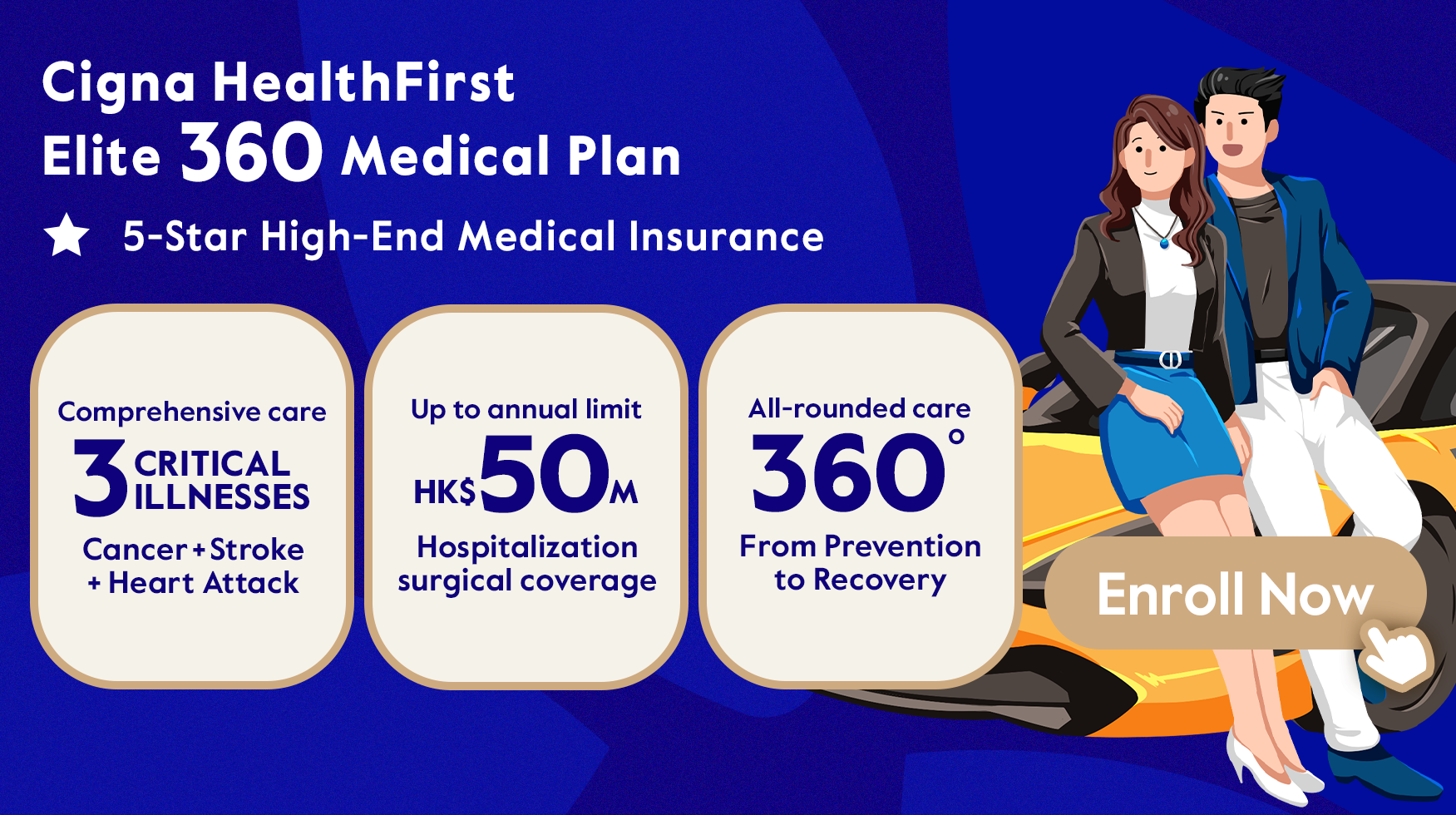

Cigna HealthFirst Elite 360 Medical Plan offers comprehensive and personalized medical coverage across the stage prevention, diagnosis, treatment and recovery, with a range of hospital and surgical benefits, optional insurance benefits with an annual limit of up to HK$50 million, personalized health assessment, three critical illnesses(cancer, stroke and heart attack) all-rounded care and international medical concierge service. A 360-degree total health protection that spans across all the key stages of your health journey. Learn more here.

Sources: