The Voluntary Health Insurance Scheme(VHIS), Tax Deductible Voluntary Contributions (TVC) and Qualifying Deferred Annuity Policy (QDAP) are the tax-saving solutions in Hong Kong. From April 2019, individuals are granted a concessionary tax deduction under salaries tax and personal assessment if they purchase Certified Plans for themselves or their specified relatives under the Voluntary Health Insurance Scheme.

This article explains how to use VHIS to provide comprehensive health protection for yourself and your family while enjoying the greatest tax deductions.

What is the Voluntary Health Insurance Scheme?

The Voluntary Health Insurance Scheme (VHIS) is designed to offer the public affordable and comprehensive insurance protection, so the VHIS-insured have an additional choice of using private healthcare services when in need.

VHIS covers insurance products that provide hospital insurance protection of indemnity nature bought by individuals for themselves and their families. In other words, VHIS compensates for the actual medical expenses of hospitalisation or day surgery.

Non-hospital medical insurance protection (e.g. outpatient services), non-indemnity medical insurance protection (e.g. hospital cash, critical illness cash plans) and group insurance bought by employers for their employees are not covered in the scheme.

Qualified VHIS Plans for Tax Deductions

Only Certified Plans certified by the Food and Health Bureau qualify for claiming tax deductions under VHIS. The plans are categorized into the Standard Plans and Flexi Plans designed by insurance providers. Both plans qualify for claiming VHIS tax deductions.

How to Calculate the VHIS Tax Deduction?

The tax deductions of VHIS are everyone's concern. For the Standard Plans and Flex Plans, the maximum amounts of the tax deduction for each policyholder are $3,000 and $8,000 respectively.

|

Certified Plans under VHIS |

Tax Deductions |

|

The Standard Plan (annual premium: $3,000) |

$3,000 |

|

The Flexi Plan (assumed annual premium: $9,000) |

$8,000 (maximum amount) |

However, the tax deductions, $3,000 or $8,000, is not directly subtracted from your taxes. The tax deduction is calculated based on your annual premium and tax rates. In the tax year of 2018/19, the standard tax rate is 15%, while the marginal tax rates are 2%, 6%, 10%, 14% and 17%. That is to say:

Tax Savings = VHIS Annual Premium x Marginal Tax Rate

If your premium is $5,000 with a marginal tax rate of 2%, your amount of tax deduction should be $100.

Eventually, how much tax you have to pay depends on your allowance.

Personal Tax Amount =(Annual Income – Allowance – VHIS Tax Deductible)X Tax Rate

Assumed that your annual income and allowance are $240,000 and $132,000 respectively, the amount of tax you need to pay equals to:

($240,000 - $132,000* - $5,000) X 2% = $2,060

*Assumption: The amount of allowance is $132,000 in the tax year of 2020/21.

Buy VHIS Plans for Your Family & Enjoy More Tax Deduction

Taxpayers can purchase VHIS plans for their specified relatives (the dependents) and apply for tax deductions for each insured person. There is no cap on the number of dependants and policies that are eligible for a tax deduction.

According to the VHIS official website, eligible dependents for the VHIS tax deduction includes:

- Spouse and children aged less than 18 / aged 18 to less than 25 receiving full-time education / aged 18 or above but incapacitated for work by reason of physical or mental disability

- Brothers or sisters aged less than 18 / aged 18 to less than 25 receiving full-time education / aged 18 or above but incapacitated for work by reason of physical or mental disability

- Parents or grandparents aged less than 55 but eligible to claim an allowance under the Government’s Disability Allowance Scheme / aged 55 or above

If Mr Wong has a monthly income of $50,000 and a family of four (his wife, a son and a daughter), how much tax can he save for purchasing VHIS plans?

|

Annual Premium |

Eligible Premium Amount |

Tax Rate |

Amount of Tax Saved |

|

|

Mr Wong |

$10,000 |

$8,000 |

15% |

$1,200 |

|

Spouse |

$8,000 |

$8,000 |

15% |

$1,200 |

|

Son |

$3,000 |

$3,000 |

15% |

$450 |

|

Daughter |

$3,000 |

$3,000 |

15% |

$450 |

|

$3,300 |

*Cigna does not provide tax advice. Please consult your tax advisor for specific or comprehensive tax advice.

With tax deduction and the 6-month premium refund, the amount of tax that Mr Wong can save this tax year is $3,300.

For more tax reduction cases and details regarding tax calculation, you could refer to the VHIS official website and the simple Tax Calculator developed by the Inland Revenue Department.

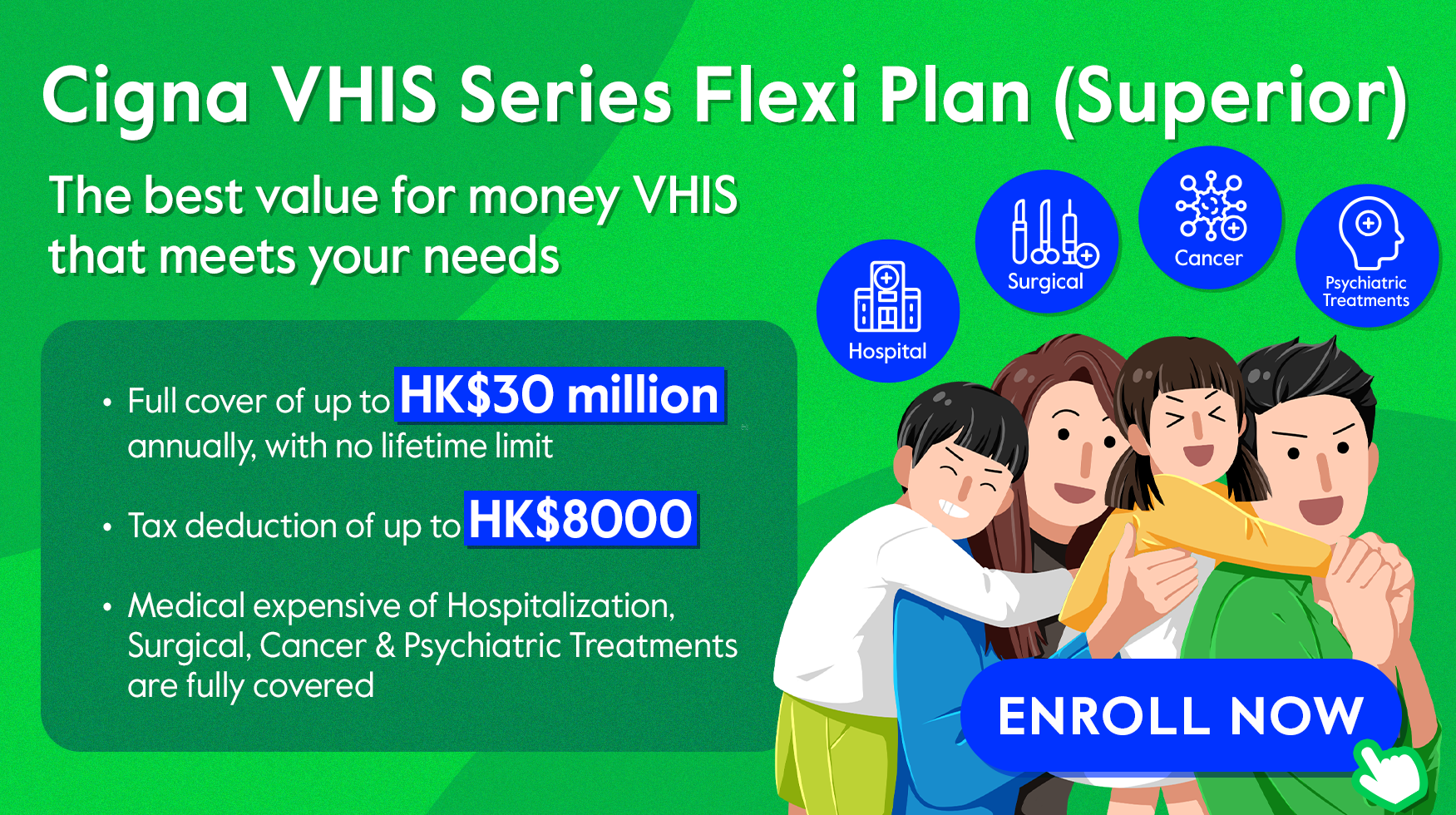

Cigna knows you deserve to be offered the easiest choice and has launched a new series of Voluntary Health Insurance Flexi Plan (Superior), aiming to deliver the best combination of price, coverage and value-added services. With a maximum of HK$8,000 per insured person in premiums eligible for a tax deduction, you can rest assured that you can anticipate and afford every dollar of your medical expenses, making our voluntary health insurance plans the smartest choice. Click here to learn more.

Sources: